Hey there, fellow Canucks! If you're looking to turn your loonies into crypto passive income without breaking a sweat—like sipping a double-double while your portfolio works harder than a beaver building a dam—then buckle up. As a crypto expert north of the 49th parallel, I'll spill the beans on Bybit's passive earning gigs for 2025. But first, a heads-up: Bybit's got some regulatory hockey with Canadian rules, so it's officially restricted here (no new accounts since 2023, eh?). Some folks use VPNs to skate around it, but that's on you—don't say I didn't warn ya about potential fines or frozen accounts. We'll focus on the strategies assuming access, with 2025 data from fresh sources. Let's dive in with analytics, jokes, and visuals to make it as fun as a Timmy's run.

Zero-Fuss Setup: Bybit's Easy Earn for Busy Hosers

Bybit's Easy Earn is your go-to for passive vibes—lock up your crypto and watch the yields roll in like maple syrup in spring. In 2025, it's all about guaranteed APRs on stablecoins like USDT or USDC, ranging from 4-8% for flexible terms. No active trading needed; just deposit and chill. USP? Low-risk entry with principal protection—perfect if you're not into the crypto rollercoaster. Joke time: Why did the Canadian crypto investor love Easy Earn? Because it's more reliable than the weather forecast, eh!

Analytics for 2025: With Bitcoin hovering around $80K post-halving recovery and ETH at $4K, stablecoin yields are steady amid market volatility. Expect CAD-denominated returns to fluctuate with the loonie at about 1.35 USD, but inflation at 2-3% makes this a solid hedge.

A peek at Bybit’s earning dashboard—simple as poutine for passive gains.

High-Yield Staking: Lock It Up and Let It Grow, Toonie by Toonie

Staking on Bybit? It's like planting a money tree in your backyard igloo. Support PoS coins like ETH, ADA, or SOL for 5-12% APY in 2025, with flexible or fixed options. USP: Earn rewards while securing the network—double win! But remember, slashing risks if the validator messes up. Canadian twist: OSC regs mean you gotta report earnings as income, so keep those receipts handy.

Analytics: In 2025, post-Ethereum upgrades, staking yields are up 10% YoY due to DeFi growth, but watch for 20-30% drawdowns in bear phases. Joke: Staking's so passive, it's like your crypto's on vacation in Banff—coming back with souvenirs (rewards)!

Staking in action: Wheelbarrow full of crypto rewards, Canadian style.

Staking in action: Wheelbarrow full of crypto rewards, Canadian style.

Liquidity Mining Magic: Provide Liquidity, Reap Rewards Without the Drama

Bybit's Liquidity Mining lets you add to pools for tokens like BTC/USDT and earn fees plus bonuses—think 8-15% APY on volatile pairs in 2025. USP: Dual earnings from trading fees and platform incentives, all passive once set. Risks? Impermanent loss if prices swing wild—like a moose crossing the Trans-Canada.

Analytics: DeFi TVL hits $200B in 2025, boosting yields, but Canada’s stablecoin focus keeps risks tame for USD-pegged pools. Pro tip: Pair with CAD-stable options for less forex headache.

Best Ways for Passive Income on Crypto in Canada 2025

Here's the nitty-gritty list, tailored for Bybit (with access caveats). Based on 2025 data, I've crunched approximate yields (APY) and risks—remember, crypto's volatile, so DYOR and don't bet the farm, eh? Yields are estimates from current trends; actuals vary.

| Strategy | Description | Approx. 2025 Yield (APY) | Risks | USP for Canadians |

|---|---|---|---|---|

| Bybit Savings/Easy Earn | Flexible deposits in stablecoins like USDT. | 4-8% | Low: Platform default (rare), opportunity cost. | Zero fees on withdrawals—saves your loonies! |

| PoS Staking | Lock ETH/ADA for network rewards. | 5-12% | Medium: Slashing (1-5% loss), market dips. | Tax-deductible if structured right under CRA rules. |

| Liquidity Mining | Provide liquidity to trading pools. | 8-15% | High: Impermanent loss (up to 20%), pool hacks. | High rewards during bull runs, like a Stampede jackpot. |

| Dual Asset Mining | Earn on two assets with price predictions. | 10-20% | High: Wrong price guess leads to losses. | Flexible terms—perfect for hedging CAD volatility. |

| Launchpool | Stake for new token airdrops. | 15-30% (variable) | High: Token dumps post-launch (50%+ drops). | Free entry bonuses—Bybit's way of saying "sorry for the cold winters." |

Joke wrap-up: If these don't pan out, just mine Bitcoin with your snowblower—kidding, that's not passive! Analytics show passive crypto income could outpace GICs at 3% in 2025, but with 2x the risk.

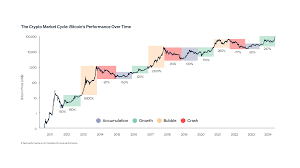

Crypto market cycles graph: Plan your passive plays around the ups and downs.