As an expert in crypto markets, I'll break down how to generate passive income on Bybit in Canada for 2025. Bybit is a popular centralized exchange offering user-friendly tools for passive earning, such as staking, savings accounts, and structured products under Bybit Earn. It's accessible to Canadians, but remember to comply with CRA regulations – staking rewards are treated as income, while capital gains from holding are taxed at 50% of your rate. Starting in 2026, platforms like Bybit may report transactions under the Crypto-Asset Reporting Framework (CARF), so track everything meticulously.

Passive income here means low-effort strategies where your crypto works for you, without active trading. Focus on diversification to mitigate volatility. Bybit's products are straightforward: deposit assets, earn yields, and withdraw flexibly. In 2025, expect yields influenced by market conditions – higher in bull runs, lower in bears.

A screenshot of the Bybit trading interface, showcasing its user-friendly dashboard for managing passive income products.

A screenshot of the Bybit trading interface, showcasing its user-friendly dashboard for managing passive income products.

Analytics Overview for 2025

The crypto passive income landscape in Canada is booming, with staking market cap exceeding $100B globally. Yields vary by asset: Ethereum (ETH) around 3-5%, Solana (SOL) 5-7%, and stablecoins like USDC up to 777% APR in promotional periods on Bybit. However, real average yields are 4-10% annually due to inflation and network factors.

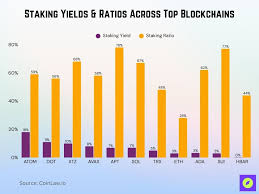

From recent data, staking ratios are high (e.g., 77% for HBAR, 68% for XTZ), indicating strong participation but potential yield dilution if more users join.

Staking yields and ratios across top blockchains in 2025, highlighting varying returns and participation levels.

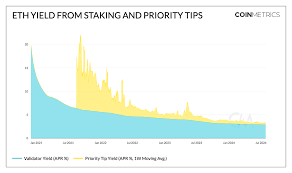

ETH staking yields have stabilized post-Merge, averaging ~4% with priority tips.

Historical ETH yield from staking and tips, showing trends leading into 2025.

In Canada, factor in 15-37% effective tax on rewards as income. Analytics suggest diversifying across 3-5 assets to balance risk – e.g., 40% stablecoins for stability, 60% in growth tokens like SOL or DOT.

Top staking networks by locked value: Cardano (ADA) $11.2B, Solana $7.4B, Polkadot $5.6B.

Breakdown of leading staking networks and their asset values in 2025.

Best Passive Income Strategies on Bybit in Canada 2025

Here are the top methods on Bybit, with approximate 2025 yields (based on current trends; actuals fluctuate), risks, and expert tips. I've used a table for clarity. Start small, use Bybit's tutorials, and consult a tax advisor for CRA compliance.

| Strategy | Description | Approx. Yield (2025 Est.) | Risks | Expert Tip |

|---|---|---|---|---|

| Staking | Lock assets to support networks like ETH, SOL, or ADA via Bybit's managed staking. | 3-8% (e.g., ETH 3-5%, SOL 7%) | Slashing (penalties for downtime), market volatility, lock-up periods (7-28 days). | Diversify across chains; use Bybit's auto-compound feature to boost returns. Ideal for long-term holders. |

| Savings Accounts | Deposit stablecoins like USDC for flexible interest, similar to a bank account. | 5-10% base; up to 777% in promos (short-term). | Platform insolvency (low on Bybit), inflation erosion, low yields in bear markets. | Opt for flexible terms; great for Canadians avoiding capital gains tax on rewards (treated as income). |

| Yield Farming/Liquidity Mining | Provide liquidity to DeFi pools integrated on Bybit Earn. | 10-50% (variable, e.g., on stablecoin pairs). | Impermanent loss, smart contract hacks, high gas fees if on-chain. | Start with low-risk pools; monitor APY via Bybit dashboard. Higher reward but more volatile. |

| Lending | Lend crypto to borrowers via Bybit's P2P or structured products. | 4-12% (e.g., BTC 4%, USDT 8-10%). | Borrower default, collateral liquidation in crashes. | Use over-collateralized loans; tax rewards as income per CRA. |

| Airdrops & Rewards | Hold qualifying tokens for free drops or Bybit bonuses. | Variable (0-100%+ one-time boosts). | Opportunity cost, scams, no guaranteed yields. | Join Bybit's reward hub; combine with staking for compounded benefits. |

Final Expert Advice

In Canada 2025, prioritize regulated platforms like Bybit to avoid issues. Aim for 5-15% net annual returns after taxes and fees, but always DYOR – crypto is volatile. Use tools like Koinly for tax tracking. If you're new, start with $1,000 in stablecoins via savings for low-risk entry. Monitor market analytics weekly, and remember: passive doesn't mean risk-free