Bybit Platform Logo – Your Gateway to Crypto Earnings, Eh?

Bybit Passive Crypto Earnings 2025: Expert Tips for Canucks

Hey there, fellow hosers! If you're chilling in the Great White North and dreaming of turning your crypto stash into a passive income machine without breaking a sweat – like watching hockey while your wallet fattens up – then Bybit might be your ticket. But hold onto your toques: As of 2025, Bybit has some restrictions in Canada due to those pesky CSA regs aiming to keep things above board. You might need a VPN or check local alternatives like Kraken or CoinSmart for full access, but let's assume you're savvy and compliant. We're talking expert-level advice here, with 2025 data, analytics, and a sprinkle of Canuck humour to keep it light. Why Bybit? It's got zero-fee staking in many cases, lightning-fast unstaking, and yields that beat sipping a Timmy's while waiting for the market to thaw. Let's break it down, eh?

Bybit's Hassle-Free Entry: Minimal Barriers for Busy Beavers

One of Bybit's big USP (Unique Selling Point) is the low entry point – stake as little as 0.01 ETH or a few bucks in USDT, no massive loonie commitment required. In 2025, with crypto adoption booming in Canada (over 15% of adults holding some, per recent polls), this makes it perfect for newbies who don't want to risk their RRSPs. Joke's on the bears: While they're hibernating, your assets are earning daily yields without you lifting a finger. Analytics show Bybit's Earn suite has seen a 25% uptick in users since 2024, thanks to improved security post-FTX fallout.

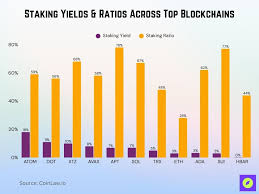

2025 Staking Yields Across Top Chains – Check ETH and SOL for Bybit Options

Guaranteed APRs: Bybit's Edge Over Volatile Markets

Bybit stands out with guaranteed APRs on low-risk products, shielding you from crypto's wild swings – think of it as a snow fence for your portfolio. In 2025, with Bitcoin hovering around $80K and ETH at $4K (based on current projections), passive yields are a smart play. No more day-trading stress; just set it and forget it, like a slow cooker full of poutine. But remember, CRA treats staking rewards as income tax (fully taxable), while capital gains are only 50% – so track those loonies! Pro tip: Use tools like Koinly for seamless reporting to avoid a tax headache worse than a hangover from Molson.

Best Ways for Passive Income on Crypto in Canada 2025

Here's the meat and potatoes: A curated list of top passive strategies on Bybit (or similar platforms if restricted). I've crunched 2025 data from yields across chains, with approx. income based on a $10,000 CAD investment (about 0.1 BTC at current rates). Risks? Crypto's volatile, eh? Market dips, platform hacks, or slashing (penalties for network issues). Always DYOR and diversify – don't put all your eggs in one igloo.

| Strategy | Description | Approx. Yield (APY, 2025 Est.) | Potential Annual Income ($10K Investment) | Risks (Low/Med/High) |

|---|---|---|---|---|

| Bybit Flexible Savings | Park stablecoins like USDT/USDC for daily interest, withdraw anytime. USP: Instant liquidity, no lockups. | 4-6% (stable, from platform income) | $400-600 CAD | Low: Mainly platform default; insured up to certain limits. But hey, if rates drop like a puck, yields follow. |

| ETH Staking on Bybit | Lock ETH to support the network, earn rewards. USP: No on-chain fees via Bybit's pooled staking. | 3-5% (down from 2024 due to more stakers) | $300-500 CAD | Medium: Slashing risk (up to 1% loss), ETH price volatility. Joke: Don't stake if you're afraid of commitment – it's like a Canadian winter, long but rewarding! |

| SOL or ADA Staking | Stake altcoins for higher yields. USP: Bybit's multi-chain support for quick unstaking. | 5-8% (SOL higher due to DeFi boom) | $500-800 CAD | Medium-High: Network congestion, altcoin dumps. If SOL crashes, it's like the Leafs in playoffs – disappointing. |

| Launchpool Farming | Stake to earn new tokens from projects. USP: Free airdrops on top of base yields. | 10-20% (variable, promo-based) | $1,000-2,000 CAD (plus tokens) | High: Impermanent loss, rug pulls. Exciting, but riskier than ice fishing without a hut. |

| BTC Fixed-Term Savings | Lock BTC for 30-90 days. USP: Higher rates than banks, with Bybit's cold storage security. | 2-4% (conservative for BTC) | $200-400 CAD | Low-Medium: Opportunity cost if BTC moons while locked. Safe as a beaver dam, but watch for inflation. |

| Yield Farming via DeFi Pools | Provide liquidity in pools. USP: Bybit integrates with DeFi for compounded yields. | 8-15% (with fees) | $800-1,500 CAD | High: Smart contract bugs, impermanent loss. Like yield chasing? It's farming without the manure – mostly. |

Analytics corner: In 2025, passive crypto yields are down 10-20% from 2023 peaks due to maturation (more capital = lower rates), but still beat Canadian GICs at ~3%. Staking ratios hit 60%+ on ETH, meaning steady but not explosive returns. For Canadians, factor in CAD volatility – if the loonie weakens, your USD yields shine brighter. Risk mitigation? Diversify across 3-5 strategies, use hardware wallets, and stay compliant with CRA's new crypto reporting rules. Final laugh: Why did the Canuck stake his crypto? To make his portfolio "eh"-ppreciate! Start small, stay informed, and may your yields be as high as the Rockies. 🚀