As a crypto expert with years of experience in decentralized finance (DeFi) and exchange-based earning tools, I'll break down the landscape for passive income on platforms like Bybit in Canada. First, a critical note: Based on current regulations as of October 2025, Bybit is restricted in Canada due to compliance issues with bodies like the Ontario Securities Commission (OSC). Canadians cannot create new accounts, deposit funds, or fully access services without potential legal risks. This stems from stricter crypto rules emphasizing registration and consumer protection. If you're in Canada, consider regulated alternatives like Bitbuy, Coinberry, or Wealthsimple Crypto for similar features. However, for educational purposes, I'll outline Bybit's passive income tools as they stand globally in 2025, adapted for a Canadian context where possible (e.g., via VPNs or offshore access, though I don't recommend bypassing regulations). Always consult a financial advisor and check local laws.

Passive income in crypto involves letting your assets work for you without active trading – think "set it and forget it" strategies. In 2025, with Bitcoin hovering around $90K and Ethereum post-upgrades, yields are stabilizing but still volatile. Bybit's Earn suite includes staking, savings, lending, and liquidity mining, offering APYs from 1-20% depending on assets and market conditions. Here's an analysis of the top strategies, with estimated 2025 yields based on current trends (note: actual rates fluctuate; check real-time data).

Market Analysis for 2025

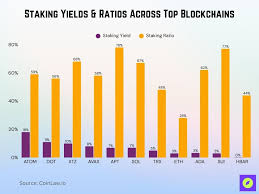

The crypto passive income sector is projected to grow 15-20% YoY in Canada, driven by institutional adoption and clearer regulations. However, volatility remains high – Bitcoin's 30-day volatility index is around 40%, impacting yields. Stablecoins like USDT dominate for low-risk earning (3-8% APY), while altcoins offer higher rewards but with slashing risks in staking. In Canada, tax implications are key: Passive crypto earnings are treated as income or capital gains, so track with tools like Koinly. Diversification across strategies reduces exposure – aim for 40% in stable assets, 30% staking, 30% lending.

Staking Yields and Ratios Across Top Blockchains in 2025 – Higher ratios indicate more locked supply, often correlating with stable yields.

Top Passive Income Strategies on Bybit (or Similar Platforms) in Canada 2025

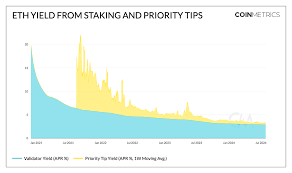

Based on Bybit's offerings and broader market data, here are the best methods. I've included approximate APYs (annual percentage yields) from 2025 averages, risks, and tips. These are estimates – e.g., ETH staking might yield 3-5% post-Dencun upgrade.

| Strategy | Description | Estimated APY (2025 Avg.) | Key Risks | Expert Tip |

|---|---|---|---|---|

| PoS Staking | Lock assets to validate blockchain transactions; Bybit handles nodes for ease. Supports ETH, SOL, ADA. | 3-8% (e.g., ETH: 3-5%, SOL: 6-8%) | Slashing (loss of funds for network issues), lock-up periods (7-21 days), market volatility. | Start with liquid staking on Bybit to avoid full lock-ups; diversify across chains like Solana for higher yields but monitor inflation. |

| Crypto Savings Accounts | Deposit stablecoins or alts into flexible/fixed-term accounts; similar to bank savings but in crypto. | 1-6% (USDT: 4-6%, BTC: 1-3%) | Platform insolvency, low yields in bear markets, opportunity cost if crypto rallies. | Use flexible terms for liquidity; in Canada, opt for CAD-pegged options if available to hedge forex risks. |

| Crypto Lending | Lend assets to borrowers via Bybit's P2P or automated pools; earn interest. | 5-12% (stablecoins: 5-8%, alts: 8-12%) | Borrower default, smart contract bugs, high fees during congestion. | Set conservative LTV ratios (e.g., 50%); monitor utilization rates – high >80% signals risk. |

| Liquidity Mining / Yield Farming | Provide liquidity to DEX pools on Bybit-integrated DeFi; earn fees + tokens. | 10-20%+ (but variable) | Impermanent loss (price divergence), rug pulls, high gas fees. | Farm stablecoin pairs to minimize loss; use Bybit's tools for auto-compounding to boost effective yields. |

| Asset Management Services | Bybit's managed funds or bots that allocate to earning pools automatically. | 4-10% (blended) | Management fees (0.5-2%), underperformance in volatile markets. | Ideal for beginners; review historical performance – aim for funds with >1 year track record. |

These strategies can compound: e.g., stake farmed tokens for layered yields. In 2025, expect APYs to dip slightly (2-5% lower than 2024 peaks) due to maturing markets, but innovations like restaking (e.g., EigenLayer integration) could push highs.

ETH Yield Trends from Staking (2021-2024) – Expect similar stabilization in 2025, with priority tips adding 1-2% extra.

Risk Management and Analytics

Crypto passive income isn't truly "risk-free" – market crashes can wipe out gains, and platforms face hacks (e.g., 2022 incidents). In Canada, add regulatory risk: Unregistered platforms like Bybit could lead to frozen assets. Analytics show that diversified portfolios yield 5-10% net after risks, vs. 2-4% in traditional savings. Use tools like DeFiLlama for real-time APY tracking.

To mitigate:

- Diversify: Don't put >20% in one strategy.

- Security: Enable 2FA, use hardware wallets for off-platform staking.

- Taxes: Report earnings; Canada taxes crypto as property.

- Monitoring: Check Bybit's (or alt's) dashboard weekly for yield changes.

Overview of Crypto Passive Income Risks and Methods – Staking and lending offer balance, but yield farming amps up volatility.

Overview of Crypto Passive Income Risks and Methods – Staking and lending offer balance, but yield farming amps up volatility.

Getting Started (With Caveats)

If accessible, sign up on Bybit, fund with crypto (not fiat in Canada), and navigate to "Earn" section. Start small: $1,000 in USDT savings for 4-6% APY. For Canadians, explore OSC-registered exchanges offering similar (e.g., VirgoCX for staking). In 2025, watch for potential Bybit re-entry if they register.

This isn't financial advice – crypto involves loss risk. Research thoroughly and invest only what you can afford.