Hey there, fellow Canucks! If you're tired of your loonies just chillin' in a sock drawer like a frozen Timbit, why not let 'em earn some crypto passive income on Bybit? As an expert who's seen more bull runs than moose in Alberta, I'm here to spill the beans on how to make your digital assets work harder than a beaver building a dam. We're talkin' 2025 vibes, with fresh data straight from the source. No hoser moves here – just smart, set-it-and-forget-it strategies tailored for Canada, where crypto's as legal as poutine but taxed like a double-double habit. Eh?

In 2025, Bybit's Earn suite is your go-to for passive gains, offering everything from staking to savings without needing to trade like a caffeinated trader. But remember, CRA treats staking rewards as income tax, and only half your capital gains get dinged – so track those like your NHL scores. Let's dive in with some USP-packed subheads, analytics, and a chuckle or two.

Zero-Effort Yields: Bybit's Flexible Savings – Your Crypto TFSA Alternative

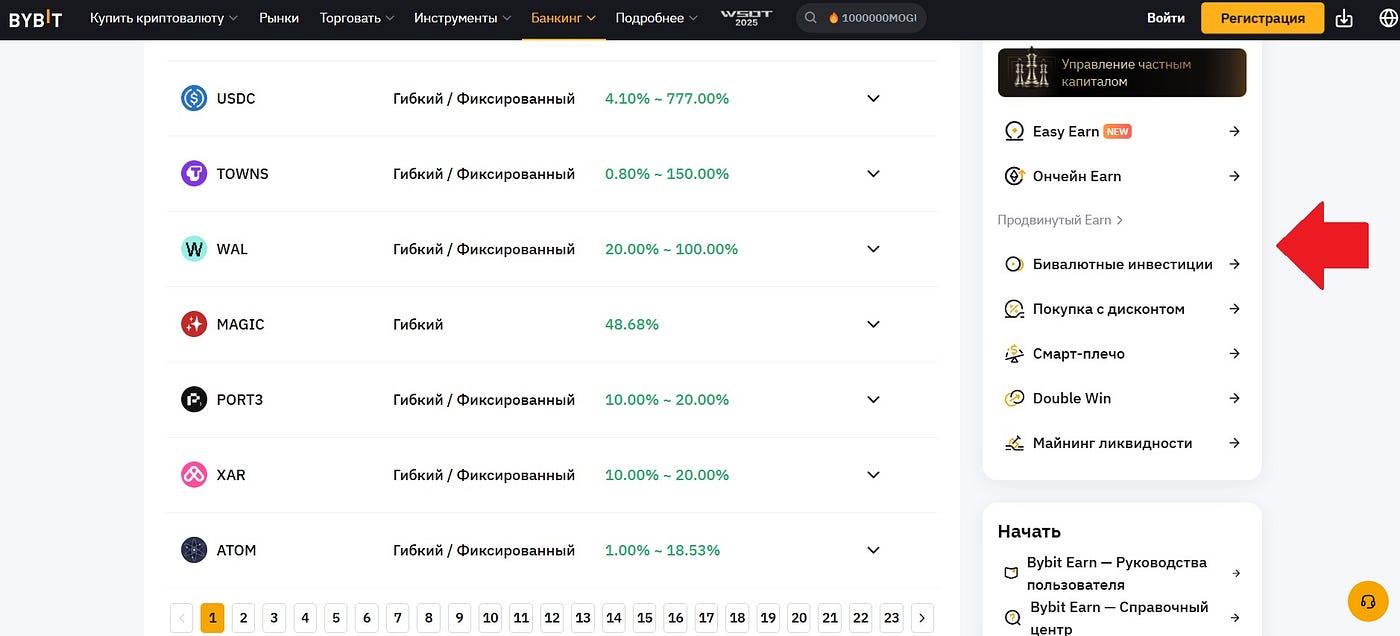

Why hustle when you can let stablecoins like USDT or USDC earn for you? Bybit's Flexible Savings is like parking your cash in a high-interest account, but with crypto flair. In 2025, expect APYs around 4-8% for USDT, based on current trends – way better than your bank's sad 2%. It's flexible, so withdraw anytime without penalties, perfect for us cautious Canadians who hate lock-ins more than a long winter.

Bybit Earn interface – easy passive setup for your crypto stash.

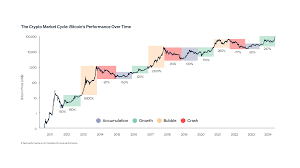

Analytics check: With crypto market cycles showing growth phases post-2024 crashes (see the chart below for Bitcoin's wild rides), stablecoin savings provide steady returns amid volatility. Joke time: It's like getting interest on your toonies – but without the coin jar spilling all over the floor!

High-APY Lock-In: Fixed-Term Staking – Beat Inflation Like a Hockey Slapshot

Stake your ETH or BTC on Bybit for that sweet proof-of-stake action. 2025 yields? Around 2.5-4.5% for ETH, 1% for BTC, with some altcoins hitting double digits. The USP? Compounding rewards that grow your stack passively, and Bybit's secure platform means no slashing worries if you play by the rules.

But hey, lock periods can be 7-90 days, so don't stake what you need for your next ski trip. Analytics: In Canada's regulated scene, staking's popular via ETFs too, with over 15 options for tax-sheltered gains. Pro tip: Diversify to avoid a single coin tanking – nobody wants to be that hoser who bet it all on one pony.

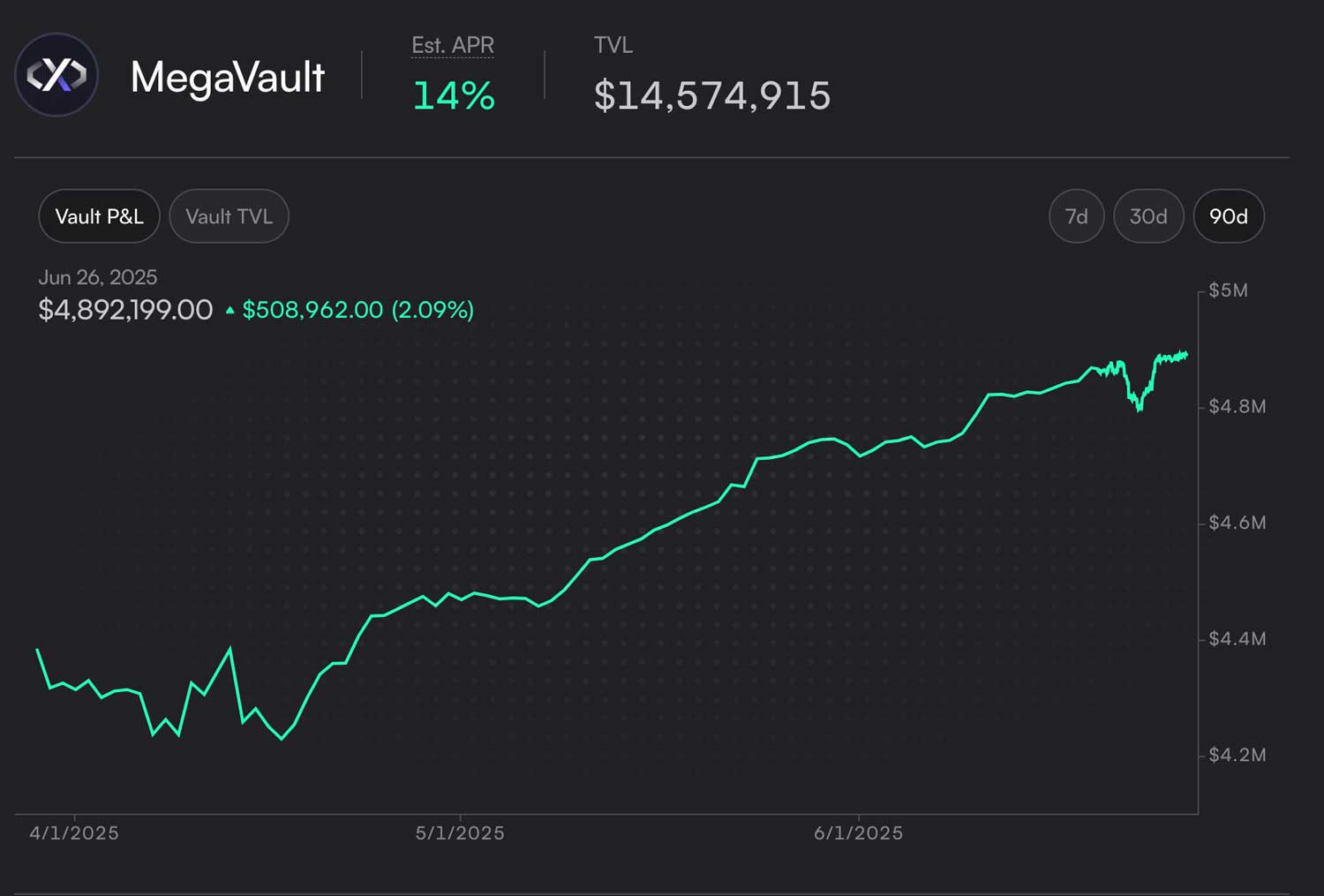

Passive income analytics chart – watch those yields climb in 2025!

Passive income analytics chart – watch those yields climb in 2025!

Risk-Reward Balance: Liquidity Mining – Earn While Providing the Pool Party

Jump into Bybit's Liquidity Mining for higher yields, like 10-20% on select pairs. USP: Dual rewards from fees and tokens, making it a step up from basic savings. In 2025, with DeFi booming, this could net serious passive dough – but watch for impermanent loss, eh? That's when prices swing and you end up with less than if you'd just HODLed.

Analytics: Market data shows passive DeFi strategies yielding 5-15% annually, but Canada's tax rules mean report everything as income. Joke: It's like lending your snowblower to the neighbour – you get paid, but if it breaks, you're out in the cold!

Stack those Bitcoins under the Canadian flag – passive style.

Best Ways for Passive Income on Crypto in Canada 2025

Here's the concrete list, bud. I've crunched 2025 estimates from Bybit's current offerings and market trends. Yields are approximate (crypto's volatile, remember?), risks rated low/medium/high. Use a table for that clean analytics look.

| Strategy | Description | Estimated Yield (2025) | Risks | USP for Canadians |

|---|---|---|---|---|

| Flexible Savings (e.g., USDT/USDC) | Park stablecoins for daily interest. | 4-8% APY | Low: Platform risk, but insured funds. No volatility if stable. | Tax-efficient for income; withdraw like grabbing a Tim's. |

| ETH/BTC Staking | Lock assets to secure networks. | 1-5% APY (ETH higher) | Medium: Lock-up periods, slashing if network issues. Market dips hurt. | CRA treats as income; pairs with TFSAs via ETFs for shelter. |

| Liquidity Mining | Provide liquidity to trading pools. | 10-20% APY + tokens | High: Impermanent loss, smart contract bugs. | High rewards in bull markets; diversify to avoid being a crypto hoser. |

| Dual Asset Products | Bet on price ranges for fixed returns. | 10-50% (short-term) | Medium: Opportunity cost if market moons. | Strategic edge without active trading; great for volatile 2025. |

| Structured Earn (e.g., Shark Fin) | Options-like products with principal protection. | 5-15% APY | Low-Medium: Tied to market performance. | Safe bet for risk-averse Canucks; beats bank rates hands down. |

These are based on Bybit's 2025 lineup and general crypto passive trends. Start small, diversify, and always DYOR – don't blame me if Bitcoin decides to pull a polar vortex!

Crypto market cycles chart – plan your passive plays around these ups and downs in 2025.

Final laugh: Passive income on Bybit's like winning the lottery without buying a ticket – but way more reliable than hoping for a loonie in your Timmies cup. Get started, eh? Stay frosty!